Why Choose TBC Asset Management:

At TBC Asset Management, we are committed to delivering strong returns and providing alternative investment opportunities. Our strategy focuses on prioritizing investor needs while ensuring consistent top performance on a risk-adjusted basis.

Unlocking Private Credit

TBC Asset Management’s Private Credit Fund is designed to deliver sustainable returns through a diversified portfolio of investments, primarily investing in senior secured corporate loans from Georgian banks’ corporate portfolios (currently – JSC TBC Bank). By focusing on high-quality credit opportunities through TBC Bank’s time tested loan generation framework, we offer investors a compelling alternative to traditional fixed income instruments.

Georgian Banking and Corporate Lending Sector

Established Track Record: With over 20 years of history, the Georgian banking sector has demonstrated resilience and growth, operating under the Basel III capital adequacy framework.

Strong Capital Base: Georgian banking system consistently maintains capital levels that exceed regulatory requirements, ensuring stability and soundness in lending practices.

Robust Banking Credit and Low NPLs: Georgian Banking system maintains low non-performing loan (NPL) ratios compared to most of the Comparable Countries, highlighting prudent credit risk management.

Corporate Credit Portfolio Growth in Georgia: c.3x growth within the last 7 years, with 16% CAGR in USD terms reaching US$ 7.54 billion by November 2024.

Corporate Credit Portfolio Growth in Georgia, US$ millions

Bank nonperforming loans to total gross loans (%), Georgia Vs. Selected Countries

Leveraging TBC Bank’s Credit Expertise

TBC Asset Management benefits from the unparalleled credit expertise of TBC Bank, Georgia’s leading financial institution:

Syndication with TBC Bank: 100% of the Private Credit Fund’s loans are syndicated with TBC Bank JSC, ensuring alignment of interests.

Extensive Market Insight: TBC Bank’s proprietary analytics and proven loan generation framework enhance our ability to identify value within the credit market.

Active Loan Administration: Post-syndication, TBC Bank remains actively involved, administering the loans and ensuring timely collection of payments, which are disbursed proportionally to the fund.

Alignment of Interests: With a syndication limit of 35% per borrower, TBC Bank maintains a significant stake in the borrower’s loans, further incentivizing effective administration.

How our fund works:

The Private Credit Fund offers a well-diversified and collateralized alternative to traditional fixed income investments. By capitalizing on TBC Bank’s credit expertise, we deliver an attractive risk-return profile to our investors.

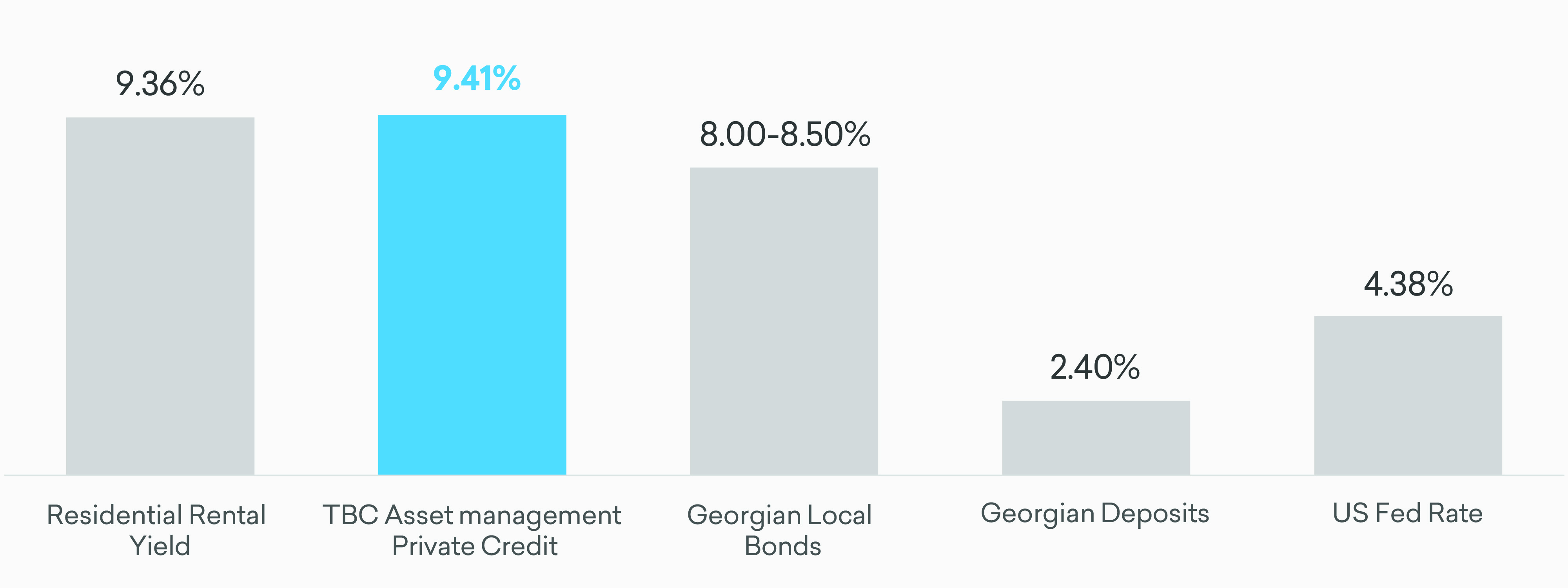

Comparing Private Credit to Traditional Fixed Income

Private Credit investments provide a compelling alternative to traditional fixed income instruments, offering higher yields and enhanced risk-adjusted returns.

Attributes of Private Credit Investment

Higher Risk-adjusted Returns: Historically, private credit has delivered higher yields than many traditional fixed income assets while introducing enhanced investor protection mechanisms.

Collateralized Senior Loans: Investments are backed by collateral, ensuring an additional layer of security.

High Investor Protection Measures: Fund Investors and TBC Bank hold Pari Passu rights, with the Fund entitled to sell back loans to the bank in specific cases of restructuring or administrative failures.

Floating Rate Instruments: Loans are structured with floating interest rates, offering protection against inflation and interest rate volatility.

Diversification: Exposure across various industries and borrowers reduces concentration risk.

Regular Cash Flow: Investors benefit from regular Dividend Distributions (Quarterly/Semi-annual), providing predictable income.

Semi-Liquid Structure: While liquidity is limited compared to international capital market instruments, the fund offers semi-annual redemptions, quarterly put options, and opportunities for secondary market transactions1.

Note:

1. Fund Unitholders (“Unitholders”) should not expect to be able to sell their Units at a secondary market regardless of how the Fund performs. The Fund does not currently intend to list its Units on any securities exchange and cannot guarantee any secondary market for them.

Yields Across Various Saving Instruments & Benchmarks – USD

Note:

Residential Rental Yield: Calculated as the average of monthly rental yields annualized using LTM data as of June 2025. Yield estimates are based on published market data and not presented as time-weighted investment returns.

Source: TBC Capital

TBC Private Credit: Asset-weighted average return of DCP 1, 2, and 3, based on LTM performance for DCP 1 as of June 2025 and annualized since-inception returns for DCP 2 and 3. Each fund’s return is calculated as a net time-weighted rate of return (TWR), based on monthly net asset values and net of management fees. Returns reflect net pre-tax performance, inclusive of distributed cash flows (dividends), but exclude fund-level taxes on dividends or capital gains (up to 5%).

Source: TBC Asset Management

Georgian Local Bonds: Illustrative coupon ranges (min-max) for USD-denominated corporate bond issuances in the local market during LTM as of June 2025. This data reflects indicative yields at issuance, not realized performance or time-weighted returns.

Source: TBC Capital, NBG

Georgian Deposits: LTM average of published annual deposit rates in local currency as of June 2025, based on NBG data. These are indicative interest rates, not representative of investment performance.

Source: NBG

USD Fed Rate: LTM average of published USD Federal Funds Target Rate based on monthly observations as of June 2025. Data presented is policy rate, not investment return.

Source: Federal Reserve Bank of St. Louis (FRED)

Illustrative Risk/Return Profiles by Instruments: Higher Returns at Lower, Diversified Risk

Disclaimer:

All investments carry risks, including the potential loss of principal, and investors may face significant losses.

Nothing published on this Website shall be construed as (a) creating any type of relationship between TBC Asset Management and the Customer, (b) a promise for a service/product or (c) any ground for contractual relations with TBC Asset Management.

Nothing contained on this Website constitutes an advice (including, investment, business, legal, regulatory and/or tax advice), recommendation, trading idea or any other type of encouragement to invest or conclude any transaction. This Website contains general information with respect to the investment matters and should not be relied upon as a professional advice, recommendation, forecast or research.

Past performance does not guarantee future income or profit Before investing, it is essential for investors to carefully evaluate the fund's objectives, risks, and fees. The prospectus contains comprehensive details, including associated risks, so please ensure you read it thoroughly before making any investment decisions.

At this stage, Funds managed by the TBC Asset Management is exclusively available to sophisticated investors within the territory of Georgia. To qualify as a sophisticated investor under Georgian law, individual must meet one of the following criteria: (i) be a member (including a director) of the governing body of a financial institution, the head or deputy head of the brokerage, trading, and/or investment department, or an employee authorized to execute transactions independently; (ii) have proven assets exceeding GEL 3 million, or an annual income exceeding GEL 200,000 for each of the past three years; or (iii) meet at least two of the following conditions: (a) you have conducted at least 10 transactions per quarter over the last four quarters with a total value of at least GEL 200,000; (b) your portfolio of securities and financial instruments, including bank deposits, exceeds GEL 1 million; (c) you have at least one year of professional experience in the financial sector, requiring substantial knowledge of financial instruments or securities transactions. In case of legal person, one must meet one of the following criteria (i) Be a financial institution, including a financial institution licensed or regulated by the authorized body of a foreign country, or an international financial institution; (ii) Be a legal entity whose capital, calculated in accordance with International Financial Reporting Standards exceeds 1 million GEL; (iii) Be a state body, autonomous republic, or municipality of Georgia or a foreign country, including bodies authorized to manage state debt and central banks; (iv) Be a person acting on behalf of or for the benefit of a pension scheme. Additionally, investor can be regarded as sophisticated by securities market intermediary if they hold this status in a developed country under Order No. 16/01 of the National Bank of Georgia, upon submission of supporting documentation.

Additional details are provided in each fund's section when reviewing the relevant information.