Diversified Credit Portfolio 2

Key Facts

Fund Objective

Provide sustainable current income through a diversified portfolio

Investment Strategy

Investing primarily in Senior Secured Corporate Loans from Georgian banks’ corporate portfolios (over 80%) and in liquid assets (up to 20%)

Risk Limits

Exposure per industry - up to 30%; Single borrower limit - max 25%; Group of borrowers limit - max 30%; Syndication limit - max 35% of the company's total leverage.

Performance

Disclosures:

All investments carry risks, including the potential loss of principal, and investors may face significant losses.

Before investing, it is essential for investors to carefully evaluate the fund's objectives, risks, and fees. The prospectus contains comprehensive details, including associated risks, so please ensure you read it thoroughly before making any investment decisions.

The performance data provided reflects past performance and is not indicative of future results. Current performance may vary and could be lower or higher than the figures shown.

The Fund result may include unaudited financial data and preliminary estimates, unless indicated otherwise in the respective factsheets.

There is no assurance that distributions will be sustained at the target level, that profits will be generated, or that dividends will be paid at all.

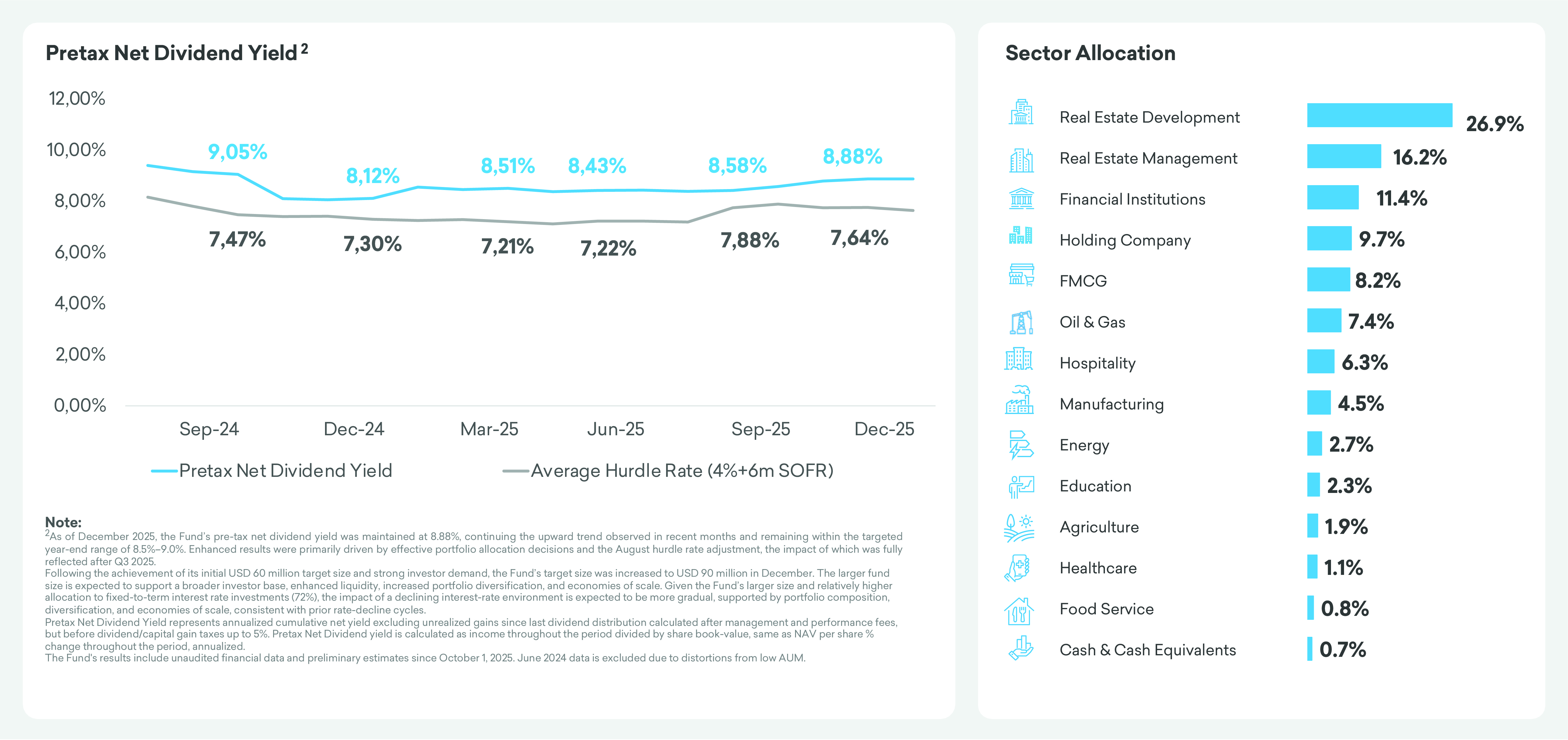

Pretax Net Dividend Yield represents annualized cumulative net yield since last dividend

distribution calculated after management and performance fees, but before dividend/capital gain

taxes up to 5%. Pretax Net Dividend yield is calculated as income throughout the period divided by

share book-value, same as NAV per share % change throughout the period, annualized.

This offering is exclusively available to sophisticated investors within the territory of Georgia. To qualify as a sophisticated investor under Georgian law, individual must meet one of the following criteria: (i) be a member (including a director) of the governing body of a financial institution, the head or deputy head of the brokerage, trading, and/or investment department, or an employee authorized to execute transactions independently; (ii) have proven assets exceeding GEL 3 million, or an annual income exceeding GEL 200,000 for each of the past three years; or (iii) meet at least two of the following conditions: (a) you have conducted at least 10 transactions per quarter over the last four quarters with a total value of at least GEL 200,000; (b) your portfolio of securities and financial instruments, including bank deposits, exceeds GEL 1 million; (c) you have at least one year of professional experience in the financial sector, requiring substantial knowledge of financial instruments or securities transactions. In case of legal person, one must meet one of the following criteria (i) Be a financial institution, including a financial institution licensed or regulated by the authorized body of a foreign country, or an international financial institution; (ii) Be a legal entity whose capital, calculated in accordance with International Financial Reporting Standards exceeds 1 million GEL; (iii) Be a state body, autonomous republic, or municipality of Georgia or a foreign country, including bodies authorized to manage state debt and central banks; (iv) Be a person acting on behalf of or for the benefit of a pension scheme. Additionally, investor can be regarded as sophisticated by securities market intermediary if they hold this status in a developed country under Order No. 16/01 of the National Bank of Georgia, upon submission of supporting documentation.

Usage Agreement

Please note :

The offer provided by this fund is applicable only to sophisticated investors as defined by Georgian legislation.

By confirming this field, you affirm that you meet the criteria of a sophisticated investor as per Georgian legislation, specifically under one or more of the following circumstances: (a) you have verified assets exceeding 3 million GEL or an annual income exceeding 200,000 GEL for the past three years; (b) you are a financial institution; (c) you are a director of a financial institution; (d) you represent a legal entity with capital exceeding 1 million GEL; (e) you represent a person recognized as a sophisticated investor according to the regulations of the National Bank of Georgia.